New home sales make it clear: Housing is in a recession

Housing Wire

JULY 26, 2022

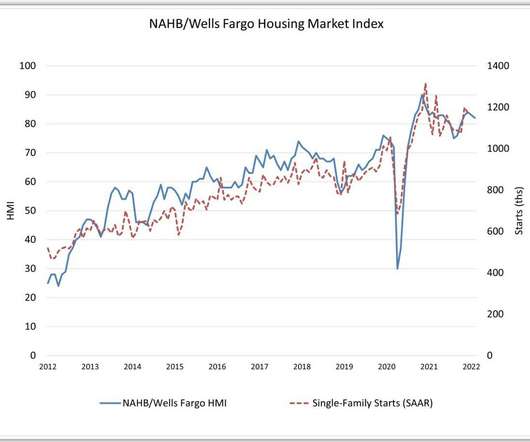

This data line confirms what we all know to be the case: The housing market, at least as it relates to construction, is in a recession. We talked about this in March , and even last year, when I wrote about the problem with the housing construction boom premise. “I don’t expect a boom in housing construction.

Let's personalize your content