New home sales are at risk with rising mortgage rates ?

Housing Wire

MARCH 23, 2022

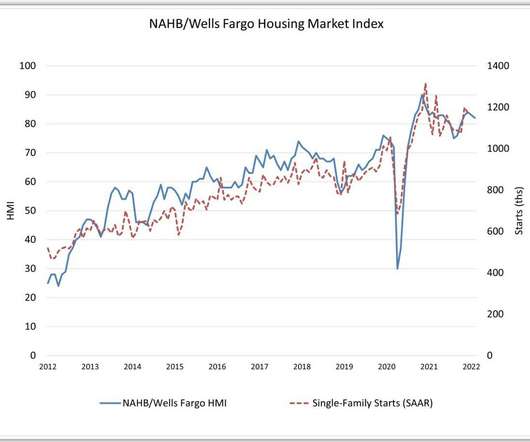

We finally got mortgage rates to rise, and for people like me who have been concerned about how unhealthy the housing market was last year — and it got a lot worse this year — it’s a blessing that was much needed. million line in the sand has been this: Home prices grow above that 23% level: check Mortgage rates spike higher: check.

Let's personalize your content