MBA: Applications for New Home Purchases Increased 1 Percent in March

Appraisal Buzz

APRIL 16, 2024

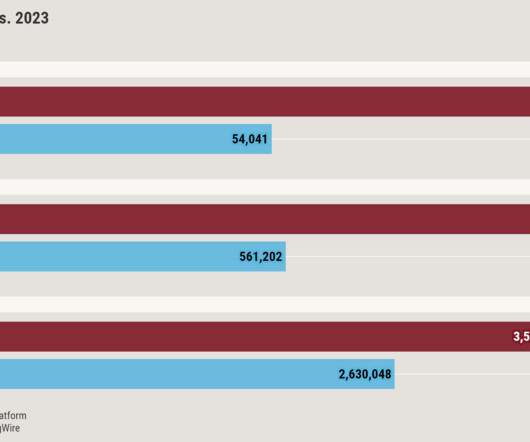

Applications for mortgages for new home purchases increased 1% in March compared with February and were up 6.2% The FHA share of applications did increase in March, exceeding 26 percent, compared to a 24 percent average for the prior 12 months. By product type, conventional loans composed 63.0% from 62,000 in February.

Let's personalize your content