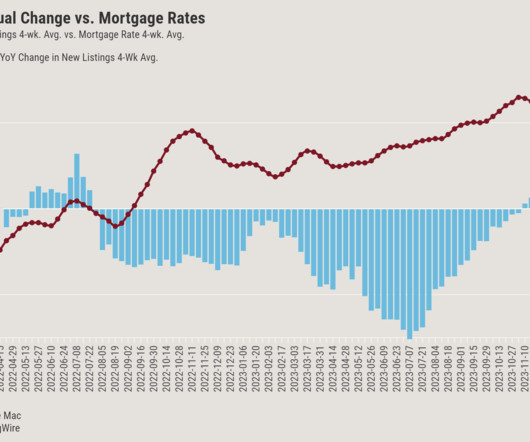

New listings data unfazed by 8% mortgage rates

Housing Wire

OCTOBER 21, 2023

The haunted house ride with the bond market and mortgage rates continued this week, but one housing data line hasn’t been spooked. New listing data appears unafraid of the mortgage rate ghost story over the last few months. Mortgage rates went from 7.66% to 8.03 % last week to end at 7.97%.

Let's personalize your content