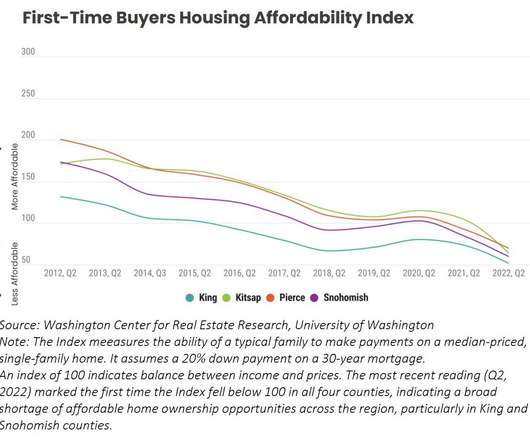

$1 million conforming loan limit reignites affordability debate

Housing Wire

NOVEMBER 29, 2022

The conforming loan limit for mortgages backed by Fannie Mae and Freddie Mac will pass the $1 million mark for the first time in 2023, reigniting a debate about the government’s role in the mortgage market and its persistent affordability challenges. nonbank lenders are wasting no time. ” Raise the (conforming loan) roof.

Let's personalize your content