Mortgage demand declines at a slower pace

Housing Wire

NOVEMBER 2, 2022

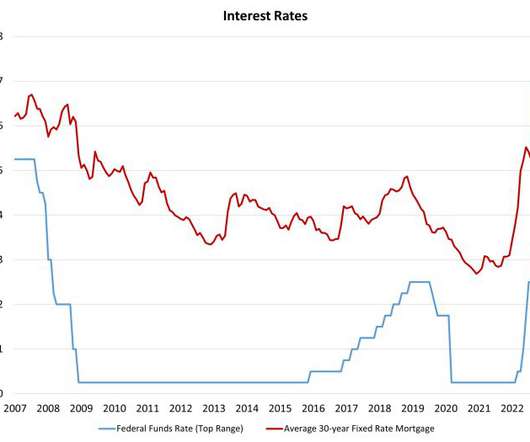

Borrowers’ demand for mortgage loans declined at a slower pace last week when mortgage rates dropped slightly ahead of the Federal Reserve ’s (Fed) meeting to announce the new target for the federal funds rate. According to the latest survey from the Mortgage Bankers Association (MBA), the mortgage composite index for the week ending Oct. 28 fell 0.5% from the prior week and 68% compared to the same period in 2021.

Let's personalize your content