Why mortgage rates are likely to drop as 2023 housing outlook remains gloomy

Housing Wire

DECEMBER 14, 2022

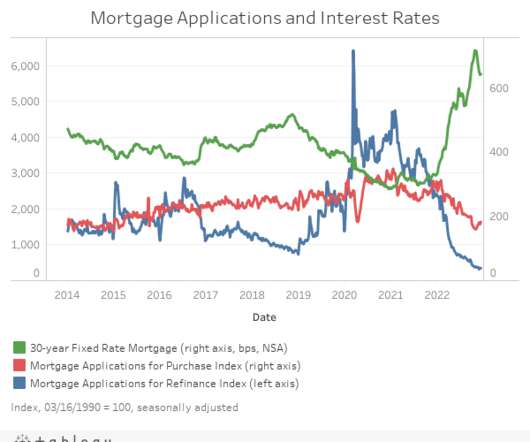

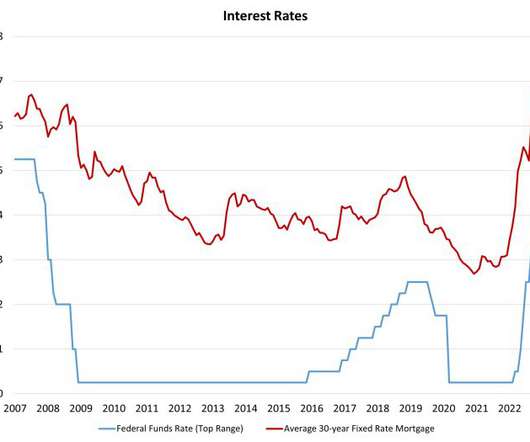

On the heels of the central bank’s announcement to raise the federal funds rate by 50 basis points to 4.25%-4.50% on Wednesday, most economists and industry experts were on the same page about the housing outlook and which direction mortgage rates would be headed. . Growing concerns of a recession, led by the Federal Reserve ’s continued interest rate hikes next year, will prompt mortgage rates to trend lower in 2023, according to numerous experts.

Let's personalize your content