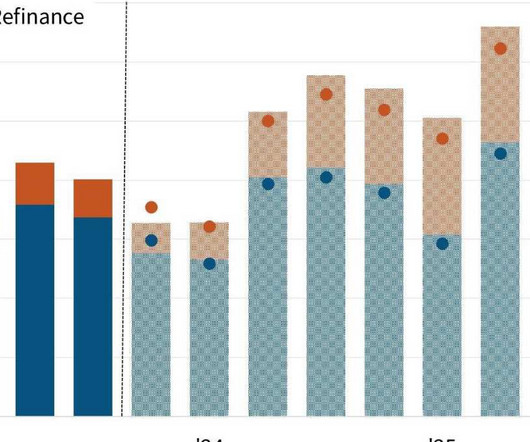

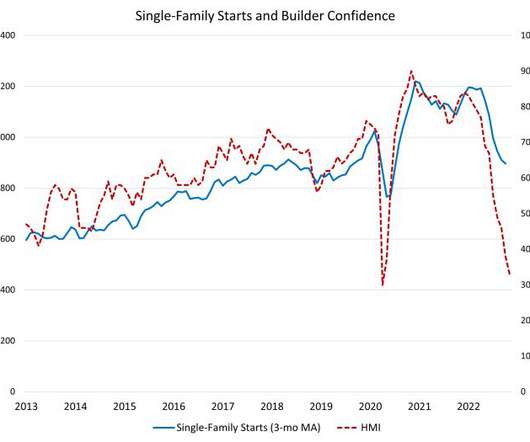

Builders apply the brakes amid canceled contracts

Housing Wire

NOVEMBER 17, 2022

For this reason, the number of housing units “under construction” is the largest ever recorded in history because they were taking so long to finish. For the builders, they have a new problem: they had homes under contract and then mortgage rates jumped in the biggest fashion ever recorded in history.

Let's personalize your content