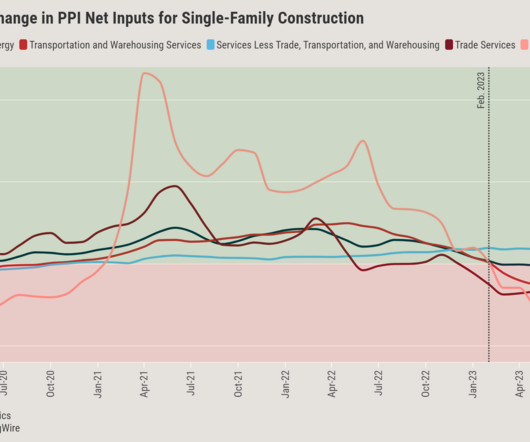

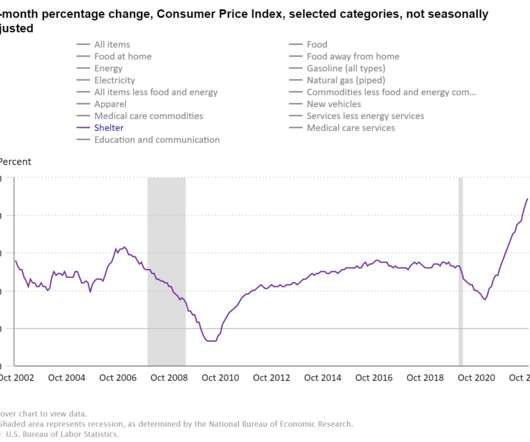

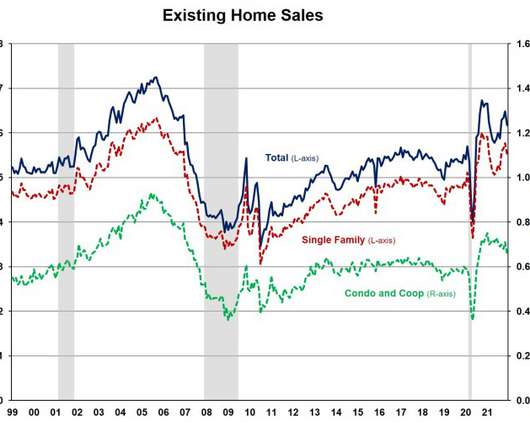

DataDigest: Construction costs easing for homebuilders

Housing Wire

JANUARY 17, 2024

However, as mortgage rates hit multi-decade highs , cooling demand and shrinking the pool of qualified buyers for new homes, homebuilders slowed their pace of construction, which settled at a plateau that is still well above pre-pandemic levels. ” However, Basu notes supply chains are already facing new pressures in 2024.

Let's personalize your content