Buyers are getting cold feet as mortgage rates exceed 7%: Redfin

Housing Wire

SEPTEMBER 15, 2023

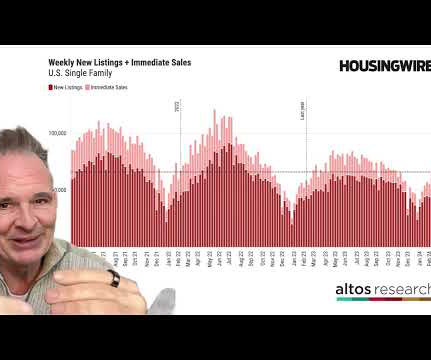

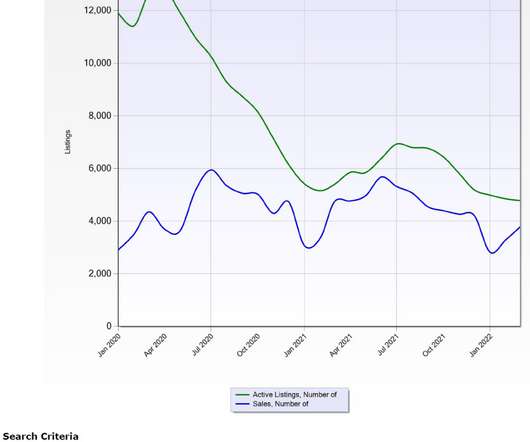

Buyers facing high mortgage rates are pulling out of their home-purchase agreements at the highest rate in nearly a year. of homes that went under contract that month, according to a new report from Redfin. Home prices not expected to fall Home prices are high due to competition among buyers for limited inventory in the market.

Let's personalize your content