Inventory needs to increase to balance housing market: Fed Beige Book

Housing Wire

JANUARY 19, 2023

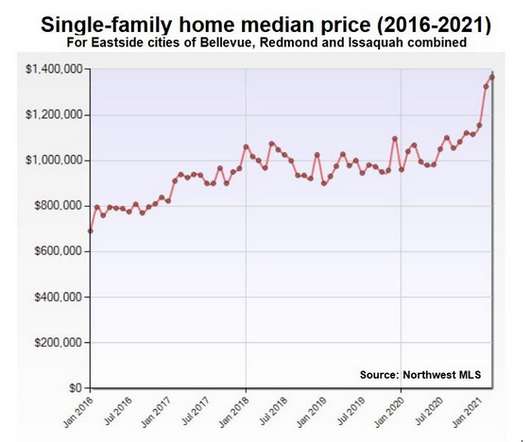

While home prices have started to inch down, more inventory is needed for a balanced housing market, the Federal Reserve Beige Book said. Housing markets continued to weaken, with sales and construction declining across [all 12 Federal Reserve] districts,” according to the Federal Reserve Beige Book released on Wednesday.

Let's personalize your content