Have we already reached peak home sales for the year?

Housing Wire

MARCH 21, 2024

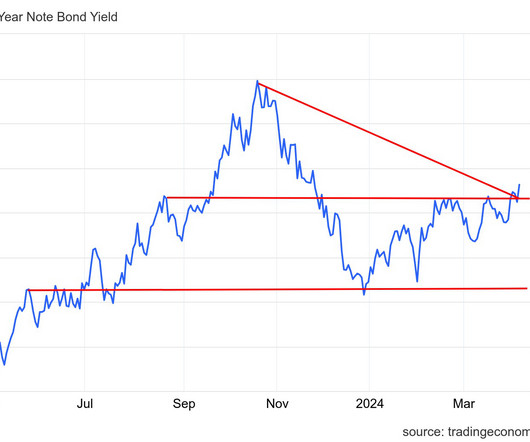

Unless mortgage rates go lower, that’s what we should expect, because that’s what happened last year. When mortgage rates headed lower at the end of 2022 into 2023, we had 12 weeks of positive weekly purchase application data. from January to a seasonally adjusted annual rate of 4.38

Let's personalize your content