Secondary mortgage market adjusts to higher-for-longer rates

Housing Wire

MAY 2, 2024

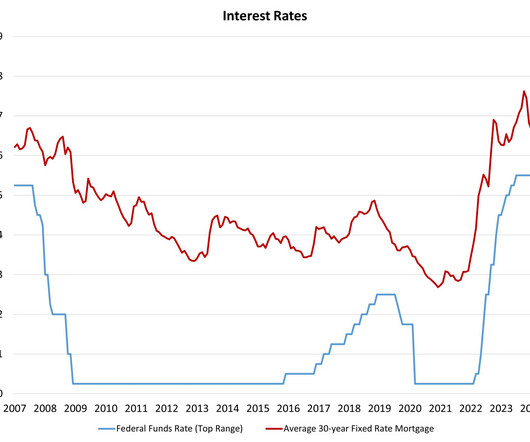

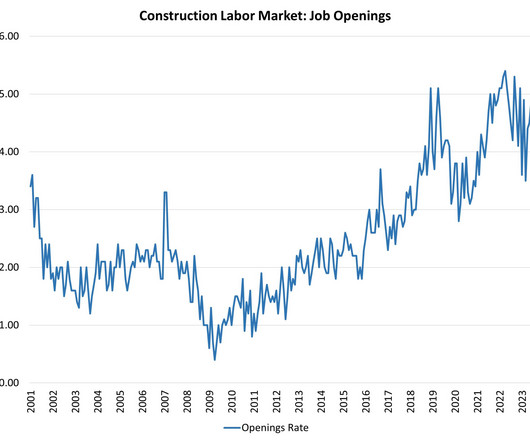

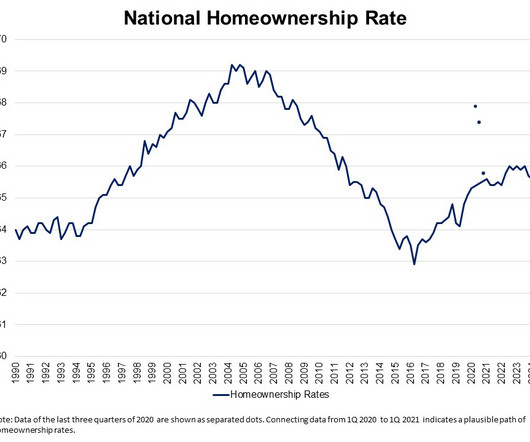

The housing market has been on a topsy-turvy roller-coaster ride in recent years that has been particularly neck wrenching since this past fall, fueled by stubbornly high inflation and a still-strong jobs market. In early November, 30-year fixed mortgage rates began a nosedive, declining from near 8% to below 7% in a matter of months before once again starting to rise at the start of 2024.

Let's personalize your content