2024 inventory growth challenges mortgage rate lockdown

Housing Wire

MAY 25, 2024

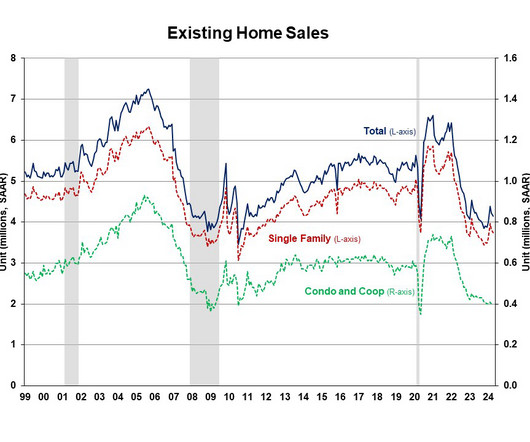

The mortgage rate lockdown premise holds that very few people will list their homes when mortgage rates are this high, thus suppressing inventory. But 2024 has proven that theory wrong. 2024 has had healthy inventory growth despite mortgage rates above 7%. Also, for the third time this year, I have hit my target of weekly inventory growth between 11,000 -17,000, thus leading to more inventory than we saw in 2023.

Let's personalize your content