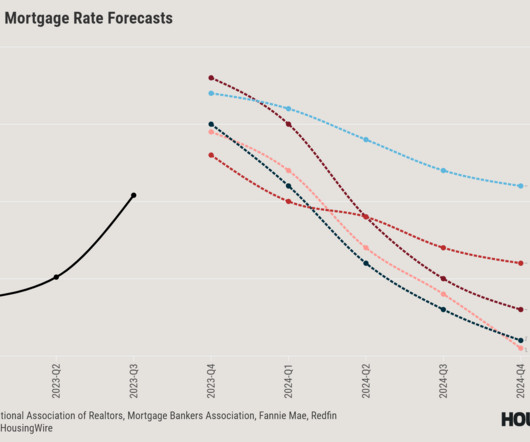

Here’s what you can expect from the 2024 housing market

Housing Wire

NOVEMBER 22, 2023

Going more in-depth than a Fed meeting, our virtual Housing Market Update event provides you with the strategy-building insights needed to operate in 2024. It’s a savagely unhealthy housing market out there, and these economists unpack what that means for you. Register for the virtual event on Dec.

Let's personalize your content