Housing inventory falls under 1M again as sales collapse

Housing Wire

JANUARY 20, 2023

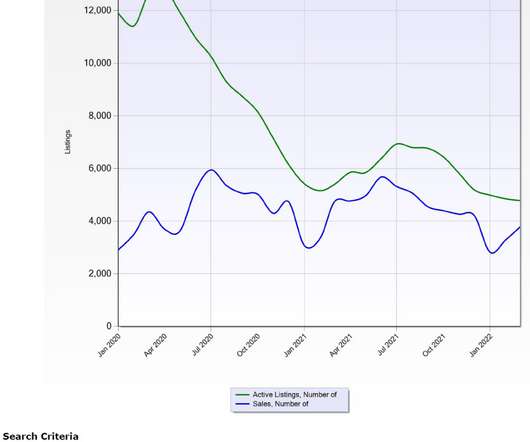

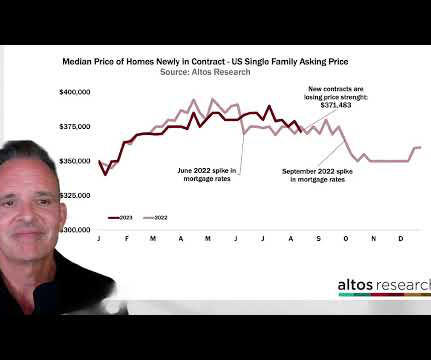

On Friday NAR reported that total housing inventory levels broke under 1 million in December, dropping to 970,00 units for a population of 330 million people. And existing home sales crashed in 2022 from a peak of around 6.5 During that period, we saw new listing data decline. The days on market were too low.

Let's personalize your content