DataDigest: Yes, buyer agents steer clients, new study claims

Housing Wire

NOVEMBER 1, 2023

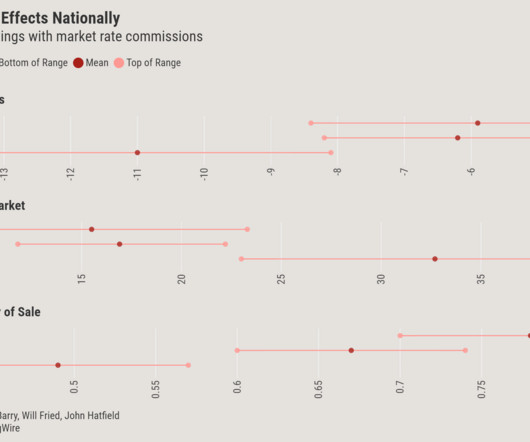

” Unnamed agent in recorded call with REX Not showing clients properties because they have below-market commission rates is an example of “steering,” a practice that is often alleged about buyer agents and just as often denied by broker firms and associations. So I’m not going to show properties that do that.”

Let's personalize your content