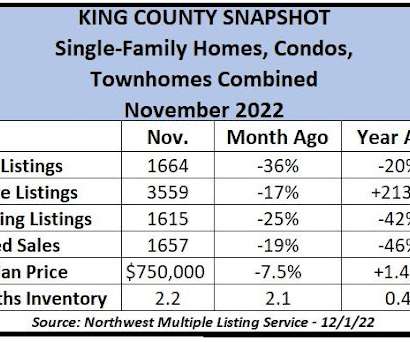

Builders apply the brakes amid canceled contracts

Housing Wire

NOVEMBER 17, 2022

However, for the first time in recent modern-day history — due to supply chain issues and other factors — housing completion data has lagged behind housing permits and starts. For the builders, they have a new problem: they had homes under contract and then mortgage rates jumped in the biggest fashion ever recorded in history.

Let's personalize your content