The awesome power of high mortgage rates

Housing Wire

MARCH 6, 2024

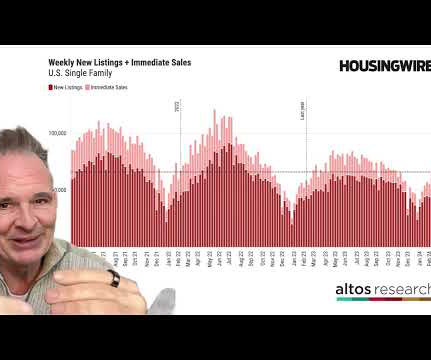

Bad for sellers Prospective home sellers may not notice incremental changes in mortgage rates. percentage points—sellers take notice. Facing these realities, many would-be sellers decide to stay put. This is clear in the chart below, which shows the year-over-year percent change in the four-week average of new listings.

Let's personalize your content