Even with low inventory, expect a strong 2021 housing market

Housing Wire

DECEMBER 3, 2020

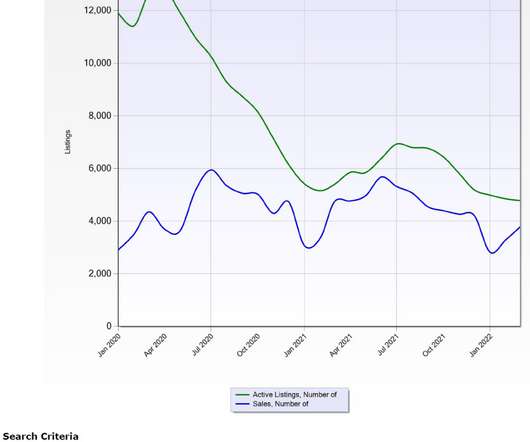

Total home sales are outpacing new listings by a wide margin every month, and real estate tech company Homesnap foresees the shortage continuing in 2021 unless more sellers enter the market. The divide between supply and demand is striking: compared to last year, total new listings increased.22%,

Let's personalize your content