Housing Market Tracker: Mortgage rates and inventory fall together

Housing Wire

MARCH 26, 2023

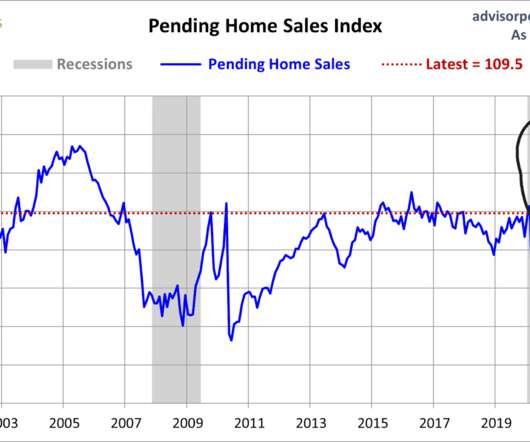

These events led to lower mortgage rates and increased purchase application data last week, but decreased housing inventory. Active inventory fell 1,109, and new listing data made a lovely comeback week to week but was still noticeably down year over year. In a regular market, they would be closer to 5.25%.

Let's personalize your content