The housing market is still savagely unhealthy

Housing Wire

APRIL 20, 2022

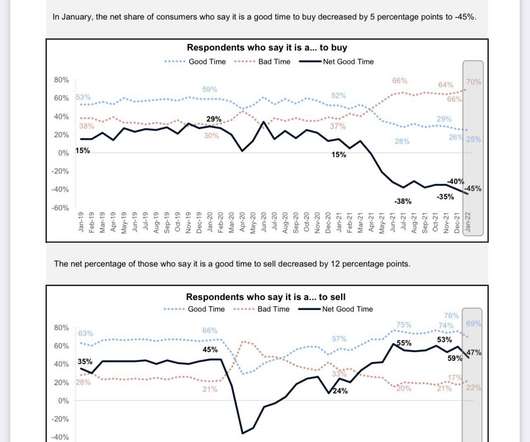

However, the real story of 2022 is that the savagely unhealthy housing market continues as inventory is still lower than last year, sending home prices growth into double digits again. housing market; the 10-year is above 1.94%, something that didn’t happen in 2020 or 2021. 2014 was the last year total inventory grew.

Let's personalize your content