New listings data falls for third week in a row

Housing Wire

MAY 18, 2024

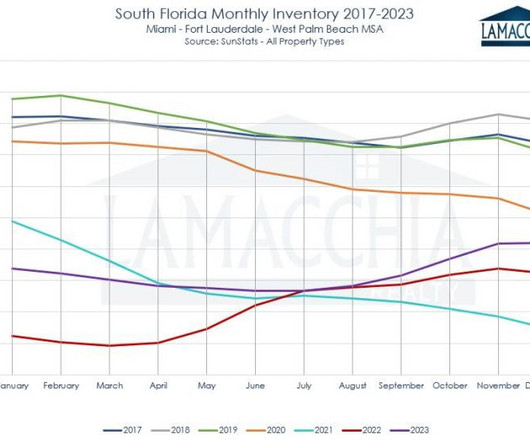

New listings data has been moving lower over the last few weeks. The moves haven’t been significant and our weekly pending contracts data picked up this week. But, we need to see more growth in new listings data just to grow from 2023 levels. We have a much more normal marketplace in 2023 and 2024.

Let's personalize your content