Homebuilders still need lower mortgage rates

Housing Wire

JANUARY 27, 2023

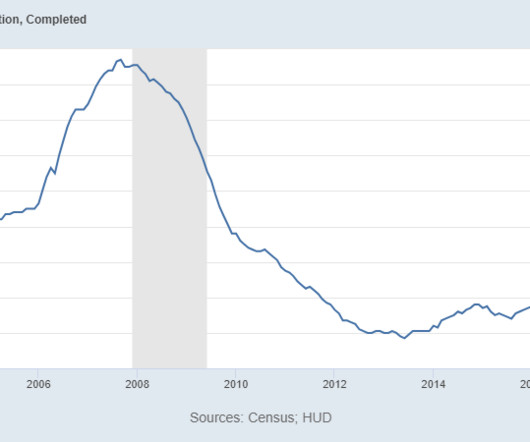

The builders don’t like to see supply of existing homes growing for fear that their buyers might cancel on them. The growth of supply means demand is getting weaker, which will require builders to give more incentives to buyers. 291,000 homes are still under construction: 5.7 months of supply. When supply is 4.3

Let's personalize your content