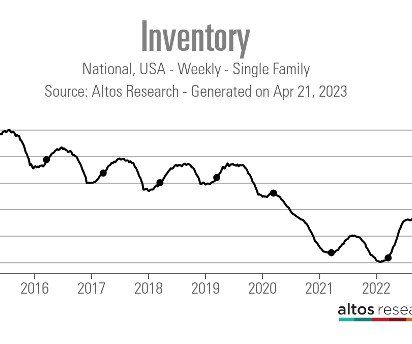

Lower mortgage rates are stabilizing the housing market

Housing Wire

DECEMBER 7, 2022

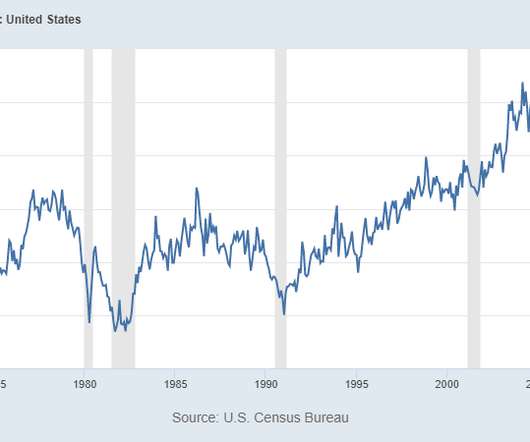

Since the weaker CPI data was released in November, bond yields and mortgage rates have been heading lower. The question then was: What would lower mortgage rates do to this data? Now, with five weeks of data in front of us, we can say they have stabilized the market. Mortgage rates went from a low of 2.5%

Let's personalize your content