Mortgage rates surge to highest level since 2000

Housing Wire

SEPTEMBER 28, 2023

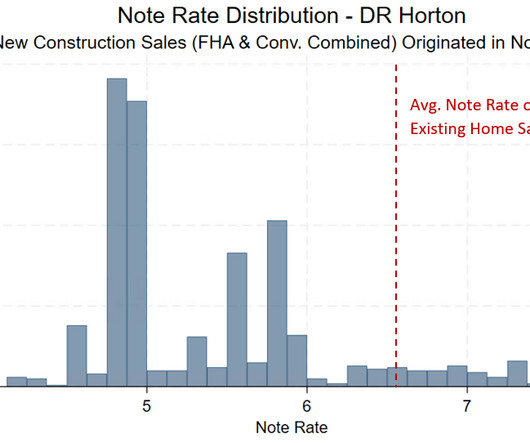

“The 30-year fixed-rate mortgage has hit the highest level since the year 2000,” Sam Khater, Freddie Mac’s chief economist said. However, unlike the turn of the millennium, house prices today are rising alongside mortgage rates, primarily due to low inventory. Other indices showed significantly higher mortgage rates this week.

Let's personalize your content