The housing market slowdown has only just begun: Fannie Mae

Housing Wire

SEPTEMBER 22, 2022

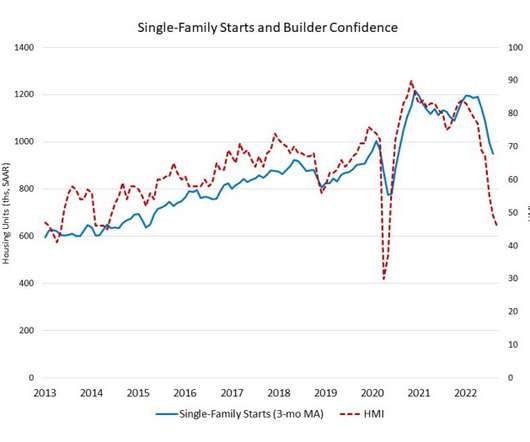

Economists at Fannie Mae say the Federal Reserve ‘s fiscal policy is having its desired effect on the housing market – home price growth began to slow in the summer, and the GSE says the housing slowdown will continue through 2023. The latest forecast also projects total mortgage origination activity at $2.44

Let's personalize your content