Key housing markets are starting to buck national trends: Redfin

Housing Wire

APRIL 26, 2024

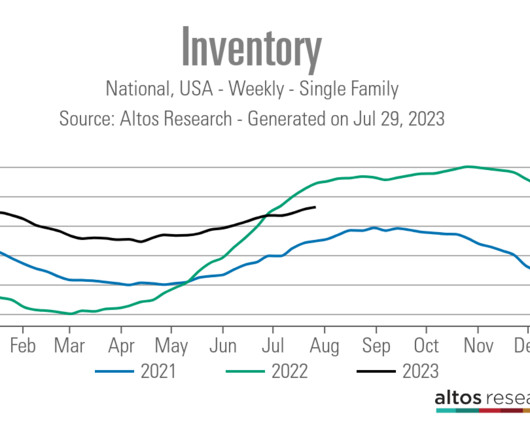

In Texas and Florida , however, key market signals show diverging trends. Major markets such as Tampa, Orlando and Dallas also posted supply growth of 20% to 30% during this period. year over year in March, although growth in listings is expected to subside due to the lock-in effect of higher mortgage rates. from 2018 to 2023.

Let's personalize your content