Housing Demand Likely to Stay High for Years to Come

Empire Appraisal Group

APRIL 22, 2021

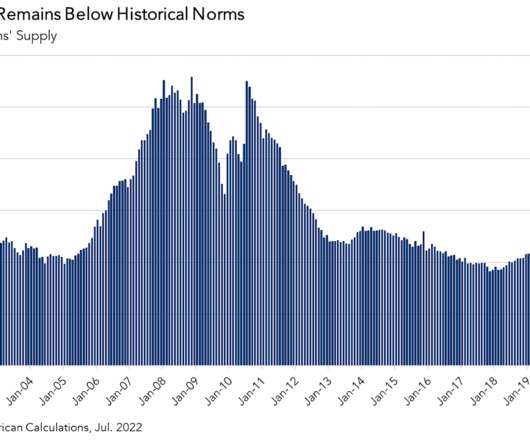

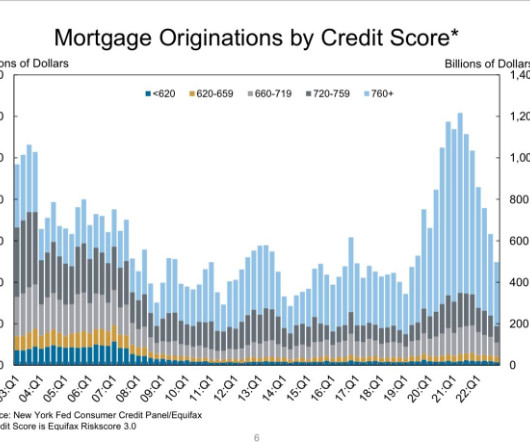

Housing Demand Likely to Stay High for Years to Come. Source: Housing Demand Likely to Stay High for Years to Come | Florida Realtors. MECKLENBURG, Tenn. – Low rates of household formation since the Great Recession have caused 5.7 million more U.S.

Let's personalize your content