Mortgage rates rise again, but look poised to drop in the fall

Housing Wire

AUGUST 10, 2023

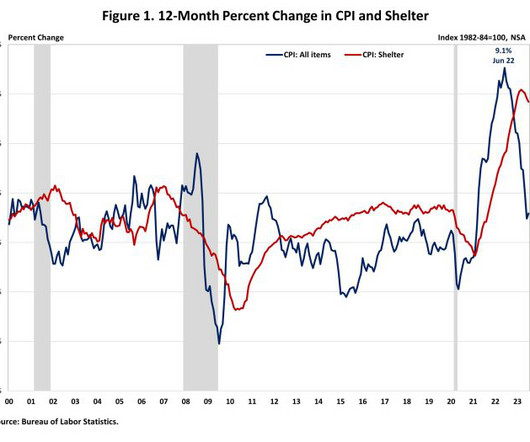

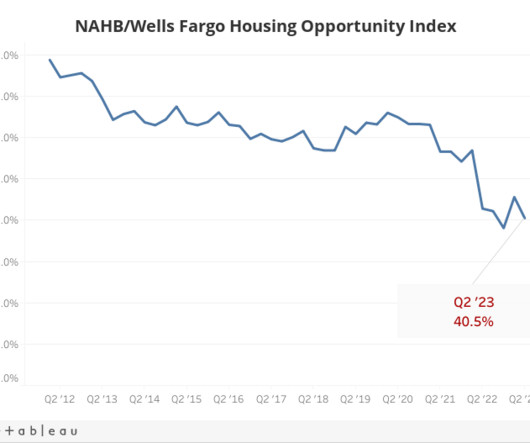

The 30-year fixed mortgage rate continued its upward trajectory for the third consecutive week, rising to 6.96%, according to Freddie Mac. Since the last FOMC meeting in July, all eyes have been fixed on Thursday’s Consumer Price Index release. Another rate hike in September would move the target federal funds rate to its highest level since March 2001.

Let's personalize your content