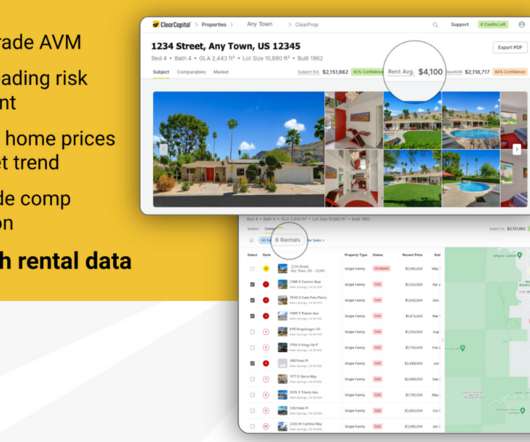

Property rental data now in ClearProp

Clear Capital

JUNE 14, 2022

We’re excited to announce that property rental data is now available in ClearProp , the lending-grade, industry-leading valuation tool. users can now review nearby rental listings and calculate a comparable-based rental estimate in real-time. Complexity Score — Assesses property complexity to inform valuation suitability.

Let's personalize your content