DataDigest: Construction costs easing for homebuilders

Housing Wire

JANUARY 17, 2024

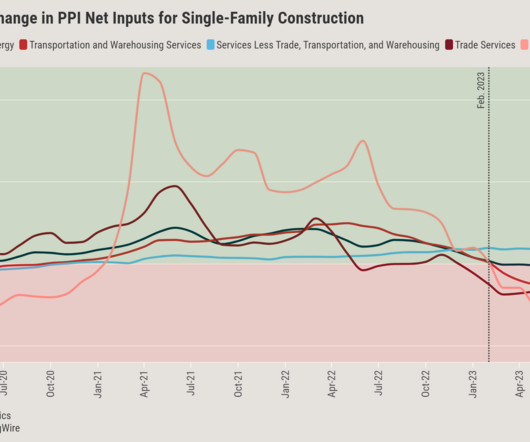

Supply shocks soothed Among the pandemic’s many ripple effects, two hit hard on homebuilders’ costs: a sudden increase in homebuyer demand and supply chain shocks due to lockdowns and capacity cuts by producers who had anticipated economic slowdowns. and many individual commodity prices actually fell.”

Let's personalize your content