Buyers continue downward spiral, but new listings may be steadying

Inman

OCTOBER 19, 2023

But new listings aren't declining as quickly, Redfin reports. Homebuyers are backing away from the market as mortgage rates continue to climb.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Inman

OCTOBER 19, 2023

But new listings aren't declining as quickly, Redfin reports. Homebuyers are backing away from the market as mortgage rates continue to climb.

Housing Wire

APRIL 15, 2024

New Orleans, San Antonio, Tampa, Orlando and Jacksonville are among the locales that posted the slowest month-over-month price growth in March. There are places where new construction relieved some pressure, and where homeowners are less locked into their mortgage, but not in the nation’s most expensive metros.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Housing Wire

AUGUST 18, 2023

Not prequalifying is unprofessional and can waste your time and the sellers. All pricing scripts are best used at the listing table! Don’t lose the listing of a motivated, have-to-sell seller over price. If they have sell, you have to take the listing! Are homes selling on average for 105% of the list price?

Housing Wire

JANUARY 10, 2024

You’re excited to get your next listing on the market, but now you’re feeling the pressure to do an amazing job for your sellers, who have put their trust in you and are excited about making a move. It can net your seller thousands or tens of thousands more when you do this right! Make sure both places shine.

Housing Wire

JULY 20, 2023

With record-low inventory nationwide, real estate agents seem to be hearing the same thing day in and day out: “I’d list my home, but where would I move?” For most agents, that’s the end of the conversation, ending the possibility of taking a new listing as well as facilitating the buyer side. Next, the house is new.

Housing Wire

OCTOBER 20, 2022

Buyers, builders and sellers take a step back as inflation persists . On the heels of heightened mortgage rates and persistent inflation, buyers, builders and sellers have taken a step back to consider their best course of action. Sellers are responding to the shift in the market and pulling back on listing activity, resulting in a 9.8%

Housing Wire

AUGUST 3, 2022

They have to move as well, so a traditional seller is a buyer most of the time when it’s a primary resident owner. Sometimes when rates go higher too quickly, some sellers can’t move, this takes a sale off the data line, but if rates fall quickly, they might feel much better about the process. Again, we aren’t there on rates yet. .

GoForrmz

OCTOBER 26, 2022

From virtual tours to real estate apps, it now takes less time and effort to communicate between sellers and buyers. Whether you’re searching for forms for construction , property management, home services, buying, or selling, we’re here to help. This means more competition at faster rates than ever before. That’s where we come in.

Housing Wire

DECEMBER 6, 2021

They have been really effective in the luxury market and new construction segments.”. Using LinkedIn has been a great way to connect with builders and developers, while Instagram caters itself well to sharing glossy photos of luxury listings, Rodriguez said. You have to be professional with LinkedIn,” Bethke said.

McKissock

DECEMBER 10, 2021

“Higher mortgage rates will end double-digit price growth and new listings will hit a 10-year high,” predicts Redfin. ” Read the full forecast to learn about Redfin’s predictions regarding mortgage rates, supply and demand, new construction, home price growth, and more. .”

Housing Wire

MARCH 1, 2024

We were up year over year in inventory , but we were at a 25 year low on new listings.” Both buyers and sellers are coming back to the market,” Fischer said. With existing inventory down, Schuler said new construction has taken on a larger role in his market. 23, 2024.

Housing Wire

NOVEMBER 9, 2023

Expired listings Expireds are near the top of the list because these sellers want to sell and many have to sell. These are the listings you’re looking for! There’s been a big increase in expireds recently since most agents still had too-short listing agreements in anticipation of the hot seller’s market continuing.

Housing Wire

AUGUST 23, 2023

Census and Department of Housing and Urban Development reported that new home sales grew faster than anticipated as the builders who are efficient are finding ways to sell homes in this higher mortgage rate environment. I often use the term efficient home sellers to describe the home builders in this low inventory environment.

Housing Wire

FEBRUARY 24, 2023

I wouldn’t read too much into the fact that this new home sales report beat estimates, but I would say that in the future, if mortgage rates get back toward 6%, the homebuilders have creative ways to sell their homes that the existing home seller might not be inclined to do. They will build as long as new home sales are growing.

Housing Wire

FEBRUARY 16, 2024

New construction starts fell to a seasonally adjusted annual rate of 1.331 million units, down 14.8% Housing inventory remained low in January and new homes still accounted for about 30% of all homes available for sale. month over month, according to a report released Friday by the U.S. Census Bureau and the U.S.

Housing Wire

FEBRUARY 16, 2023

In an odd twist of fate, the delays due to COVID-19 are currently an infrastructure and jobs program for Americans in the construction industry. As you can see below, housing completions are slowly moving along; the homebuilders have more new homes under construction that they haven’t even started yet than active new homes for sale.

Housing Wire

JANUARY 5, 2023

However, weeks after that call, the new listing data started to decline noticeably, which makes that call much harder to happen in 2023. However, I acknowledge that the housing dynamics have changed a lot since that forecast in June as new listing data declined. million in 2023. million for 2023. Housing recession.

Housing Wire

JANUARY 19, 2023

High inflation has reduced consumers’ purchasing power, which has led to weakened sales and construction across all 12 Federal Reserve districts. Housing markets continued to weaken, with sales and construction declining across [all 12 Federal Reserve] districts,” according to the Federal Reserve Beige Book released on Wednesday.

Housing Wire

JANUARY 19, 2024

Yesterday on CNBC , I talked about the state of the housing market and how important it was that the builders’ confidence data was rising because that keeps construction workers employed and building homes. This is a positive for housing in 2024 as most sellers are buyers.

Listing Spark

DECEMBER 23, 2020

Across the major markets in Texas, our December real estate market update shows clear data points that we are ending the year in one of the strongest seller’s markets we have seen in modern history. . Median Sales Price: $270,000 (up 12%) Closed Sales: 9,660 (up 28.1%) Active Listings: 29,948 (down 27% from this time last year) 2.2

Will Springer Realtor

AUGUST 15, 2023

Sellers, too, are waiting for the easing of rates before looking for their next home, as estimates show 60% of today’s homeowners possess a mortgage with an interest rate of 4% or less. The single-family housing market is sluggish, as many prospective buyers and sellers have chosen to focus on enjoying the many weeks of beautiful weather.

Listing Spark

SEPTEMBER 25, 2023

From late summer of 2022 to now, the Texas real estate market has experienced one of the most unpredictable corrections in recent history, leaving a lot of home-buyers and sellers scratching their heads and trying to make sense of what is going on. The big twist? A sharp increase in interest rates.

Housing Wire

JULY 25, 2022

Homes listed for sale are increasingly seeing asking-price reductions, and both construction and home sales — both existing and new — are slowing.”. Cleveland — Residential construction and real estate activity softened further amid rising interest rates. Single-family construction declined slightly.

Housing Wire

SEPTEMBER 12, 2023

So, the author tried to use new construction prices from back in April to describe the whole U.S. Supply of homes for sale is very low, and most of the year we’ve had more buyers than sellers. There are no signs of any surge in listings, and as a result we’ve seen a floor on home prices. housing market now.

Listing Spark

JANUARY 12, 2023

Home sellers should focus on their local market and pull out all the stops when listing a house. 2022 Market Trends: Decrease in sales, values, and new listings in Austin, TX; median home value up 9.9% Prices have been falling in the market and it is becoming more normal to do a price drop on your listings.

Listing Spark

FEBRUARY 7, 2024

On the heels of the largest run up in home values in recorded history, we saw an abrupt and heavy shift that’s been challenging to grapple with for sellers and buyers. Days on market climbed, sellers’ became restless and our month’s supply of inventory finally started to grow. The only problem, nobody wanted a 7.5% in 2022 to 3.4

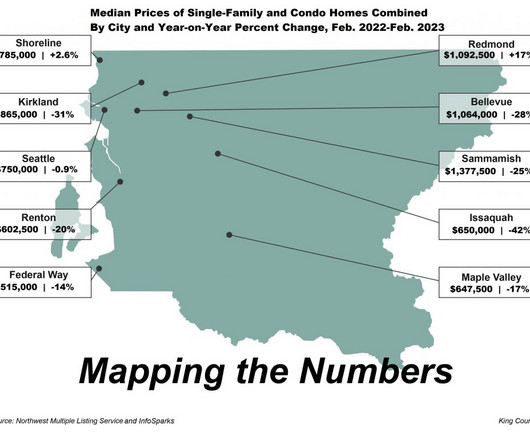

Will Springer Realtor

MARCH 10, 2023

Unless the listed home is in a favorable location, priced competitively and move-in ready, activity has been somewhat muted as prospective buyers and sellers wait for economic conditions to improve. Sellers who priced their homes appropriately enjoyed busy open houses in their first weekend on the market followed by multiple offers.

Will Springer Realtor

MARCH 12, 2024

As a result, home buyers and sellers across Seattle/King County saw a mixed bag of activity in February, according to the Northwest Multiple Listing Service (MLS). About two-thirds of all King County listings sold last month at the list price or above, signaling a competitive environment and extending this long-running sellers’ market.

Will Springer Realtor

SEPTEMBER 8, 2021

Others – Meritage Homes (+20% YoY in 2021) and Tri Point Homes (+15-30% YoY in 2022) – expect tremendous growth of new communities. And many of the new projects are larger than in years past. Builders began construction on just under a million single-family homes in 2020. Active listings as of Sept. SMILE FOR THE CAMERA.

Will Springer Realtor

MAY 13, 2024

Builders are trying to catch up and, according to federal officials , there are more housing units under construction today than at any time in the last 50 years. An annual survey released this month by the Federal Reserve Bank of New York said renters put the probability of ever owning a home at 40%, down from 44% last year.

Lamacchia Realty

MARCH 29, 2022

It also looks at other metrics like New Listings and New Pending Sales as they are often the best indicators for predicting future trends in the market The inventory crisis last year caused demand to spike higher than ever by fall and into the winter, which in turn caused prices to continue to increase significantly.

Will Springer Realtor

SEPTEMBER 12, 2023

The market is spooking many potential buyers and sellers thanks to stubbornly high mortgage interest rates. Only buyers and sellers who must move are doing so. fewer new listings, the rate of sales rose 1.7% fewer new listings (1998) compared to July and 5.0% The new home market was 31% of the total U.S.

Listing Spark

MARCH 9, 2023

But as potential buyers and sellers begin mapping out their plans for the future, understanding how the state’s real estate market is shifting is essential. This left sellers either frantically trying to unload their properties or riding out the storm and hoping for values not too badly impacted by this spike in costs.

Berkshire Hathaway

MAY 5, 2021

The trend this year seems to be among buyers “why is it so hard to find a house” Well one of the answers is we are in the ultimate sellers’ market, which means the market it very competitive for buyers right now. Low inventory in the housing market isn’t new, but it is becoming a lot harder to navigate.

Will Springer Realtor

FEBRUARY 13, 2024

And, despite the rise in new listings, the number of homes still on the market on Feb. The figures were promising from the single-family-home category as well, with new listings jumping 129% (1335) from December in King and up a negligible 0.5% fewer (1842) than on Jan. from a year ago. more versus January 2023.

Will Springer Realtor

DECEMBER 19, 2023

The region’s real estate scene in 2023 will be remembered for rising home prices and scant new listings. Buyers and sellers tiptoed through caution. As the year dims, all eyes fixate on 2024’s potential: a hopeful dance fueled by dreams of lower rates and a wave of new homes for sale. Um, bye-bye! for all of 2024.

Lamacchia Realty

JANUARY 24, 2022

It also looks at other metrics like New Listings and New Pending Sales as they are often the best indicators for predicting future trends in the market. Broward County single family sales, new listings and pending sales decreased, but average price increased year over year. Seller Resources. Broward County.

Will Springer Realtor

MARCH 14, 2023

Unless the listed home is in a favorable location, priced competitively and move-in ready, activity has been somewhat muted as prospective buyers and sellers wait for economic conditions to improve. Sellers who priced their homes appropriately enjoyed busy open houses in their first weekend on the market followed by multiple offers.

Housing Wire

JANUARY 20, 2021

fell to a four-month low in January as builders expressed concerns about higher house prices, COVID-related supply chain issues and construction costs. Homebuilder confidence in the U.S. Inventory has been an issue for real estate agents and brokers since early 2020, as well. Even prior to the pandemic , housing inventory had hit record lows.

Will Springer Realtor

AUGUST 11, 2023

Others are specializing in the design and construction of accessory dwelling units (ADUs) as detached backyard homes (also known as “ mother-in-laws ”). The national trend for new construction, however, is generally moving in the opposite direction. In the 1990s, one-third of new homes were smaller than 1800 sq.

Will Springer Realtor

SEPTEMBER 12, 2023

A concrete and steel cover connecting First Hill to downtown, for example, would reduce traffic noise, potentially add more parkland and encourage construction of new housing. The market is spooking many potential buyers and sellers thanks to stubbornly high mortgage interest rates. While there were 5.8% I know, right?!)

Lamacchia Realty

FEBRUARY 25, 2022

It also looks at other metrics like New Listings and New Pending Sales as they are often the best indicators for predicting future trends in the market The inventory crisis last year caused demand to spike higher than ever by fall into winter, which in turn caused prices to continue to increase significantly. Seller Resources.

Will Springer Realtor

APRIL 11, 2023

Existing-home sales, pending contracts and new-home construction pending contracts have turned the corner and climbed for the past three months.” Pending sales are one of our favorite housing market data points – along with the number of mortgage applications and new listings – to track buyer intent and market intensity.

Will Springer Realtor

JULY 13, 2023

Our urban area accounts for about half of the city’s economic activity, and the Seattle Chamber noted that rising office vacancies coupled with less construction could lead to $2B in decreased revenue. We certainly see that in all forms of residential real estate – from new construction to finding items for the home.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content