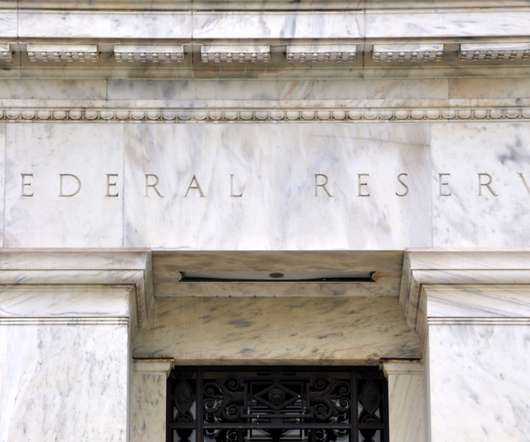

What’s pushing mortgage rates higher?

Housing Wire

OCTOBER 3, 2023

Mortgage rates and bond yields kept rising Tuesday as the job openings unexpectedly increased more than anticipated. And will job openings continue higher, pushing mortgage rates even higher in the future? As I write this article today, the 10-year yield is 4.79%, with mortgage rates at 7.72%. million and 5.7

Let's personalize your content