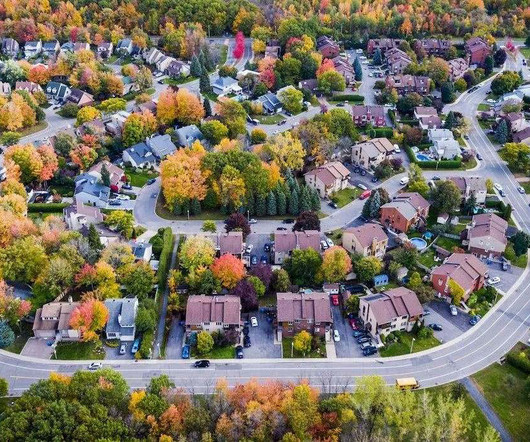

Going to Extremes

Appraisal Buzz

MAY 6, 2024

Add to this rising replacement costs and legal fees, increased government regulation, inflation, and fraud, and companies are bleeding about a billion dollars every three weeks. You may be wondering how this all trickles down to the appraisal report. The post Going to Extremes appeared first on Appraisal Buzz.

Let's personalize your content