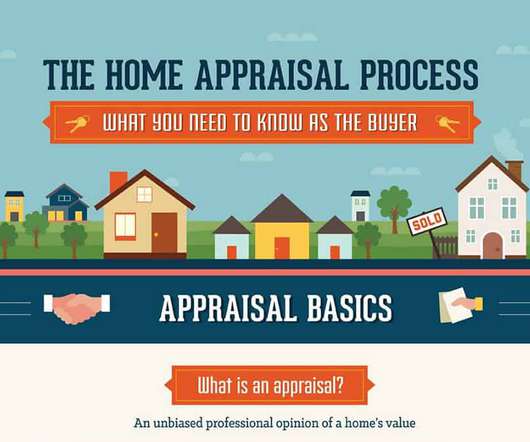

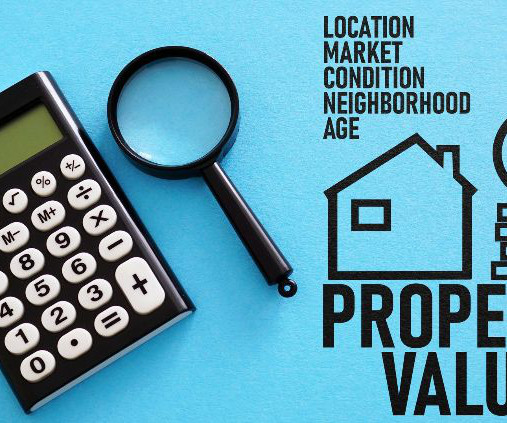

Unwrapping what to expect in your home inspection, appraisal and closing

Housing Wire

JUNE 11, 2021

A home inspector, hired and paid by the buyer typically, will look at the plumbing, electricity and the overall foundation of the home and then provide a report with their findings. While home inspections aren’t required, they provide the buyer with several important opportunities in the home-buying process.

Let's personalize your content