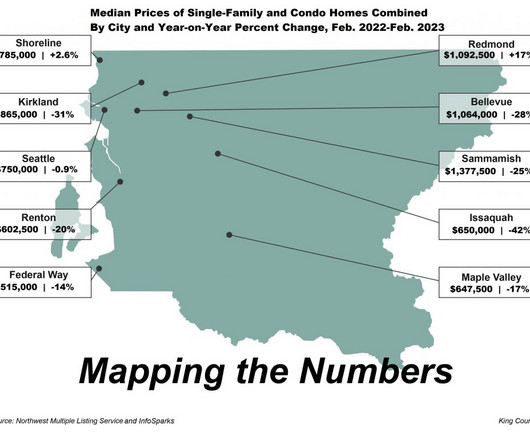

Existing home sales data shows extent of housing inflation

Housing Wire

SEPTEMBER 22, 2022

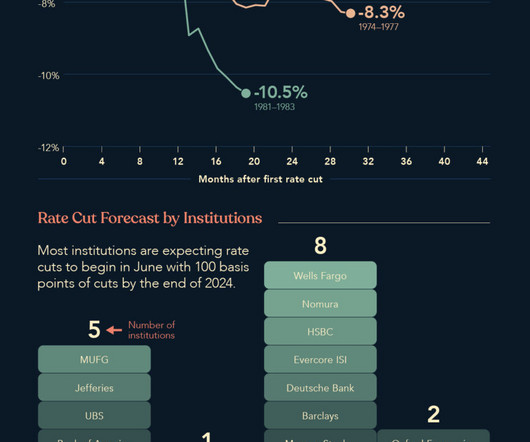

With the home-price growth we had in 2020 and 2021, my five-year price-growth model that I set for 2020-2024 of 23% was already smashed in just two years. Existing home sales have more legs to go lower, especially now that new listing data is falling. However, the secondary negative impact was going to be more painful.

Let's personalize your content