The mortgage rate lock-in didn’t start in 2022

Housing Wire

MAY 15, 2024

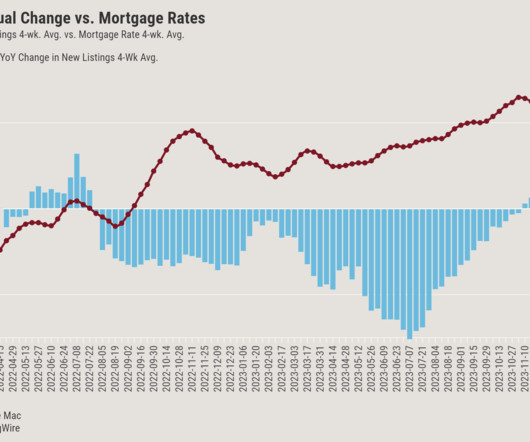

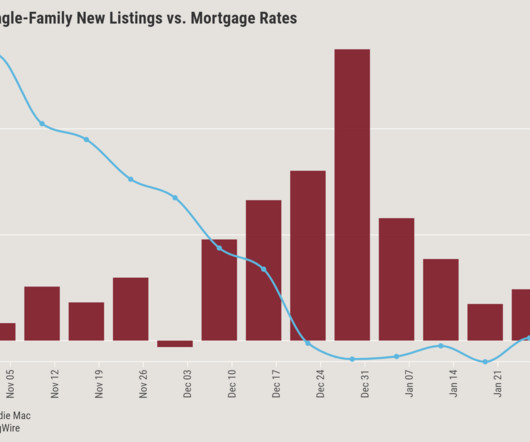

This is an excerpt of a HousingWire Research report titled: What Everyone Needs to Know about Mortgage Rate Lock-in, by Altos President Mike Simonsen. In the 24 months beginning March 2022, the U.S. housing market saw dramatic changes in affordability as mortgage rates skyrocketed 500 basis points.

Let's personalize your content