The awesome power of high mortgage rates

Housing Wire

MARCH 6, 2024

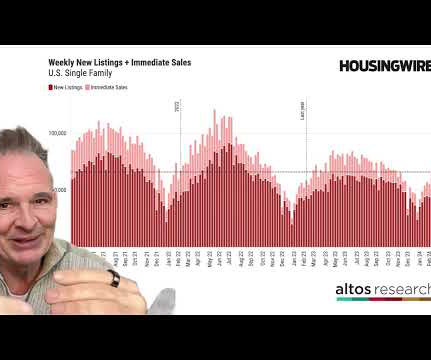

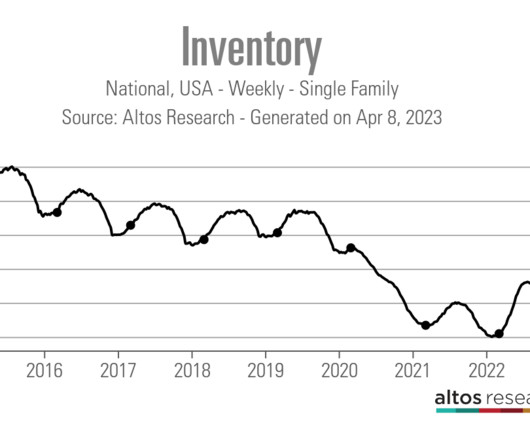

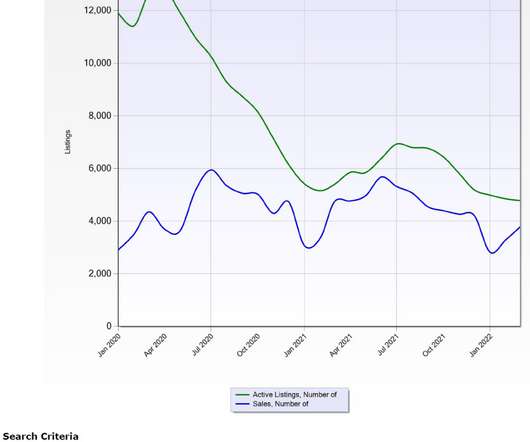

Housing professionals already know that high mortgage rates are bad for business. But with mortgage rates ascending past 7% according to HousingWire’s Mortgage Rates Center , those hopes have so far been dashed in 2024. Bad for sellers Prospective home sellers may not notice incremental changes in mortgage rates.

Let's personalize your content