The standoff between homebuyers and sellers

Housing Wire

OCTOBER 11, 2022

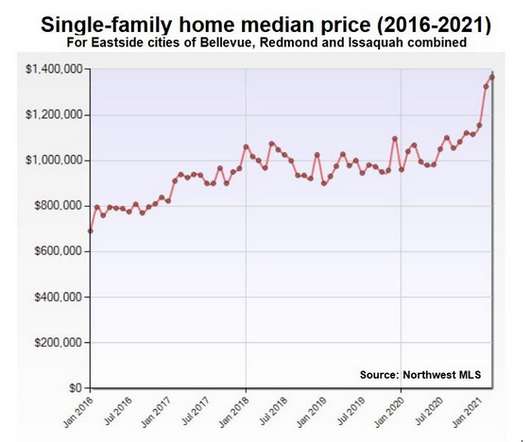

There’s a showdown at the housing market corral between homebuyers and sellers. It facilitated a very unhealthy housing market in 2020-2021 that became savage in 2022. It facilitated a very unhealthy housing market in 2020-2021 that became savage in 2022. It wasn’t part of my forecast in 2020 or 2021.

Let's personalize your content