Special report: Jacksonville’s brokerage competition visualized

Housing Wire

MARCH 27, 2024

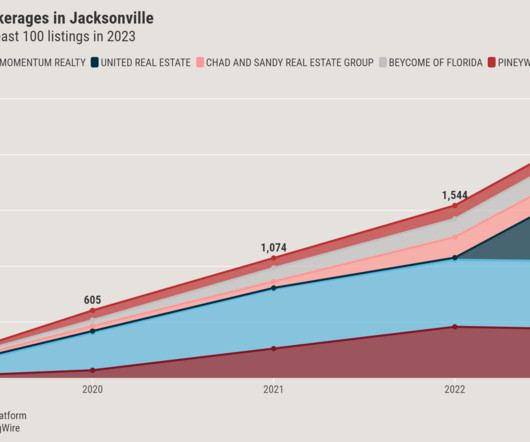

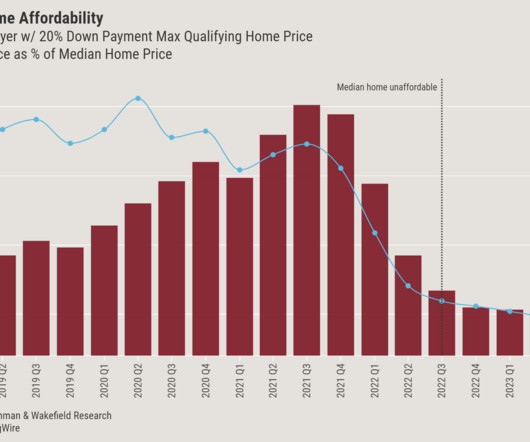

Those advantages, coupled with cheap land, made the city a favorite for homebuilders like DR Horton and Lennar that brought plenty of new inventory to market. But high mortgage rates and high home prices proved too much for the listings boom in Jacksonville. Competition heats up In 2019, Watson Realty Corp.

Let's personalize your content