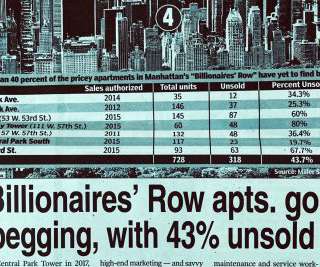

Billionaires Row Continues to be Challenged

Miller Samuel

MAY 4, 2019

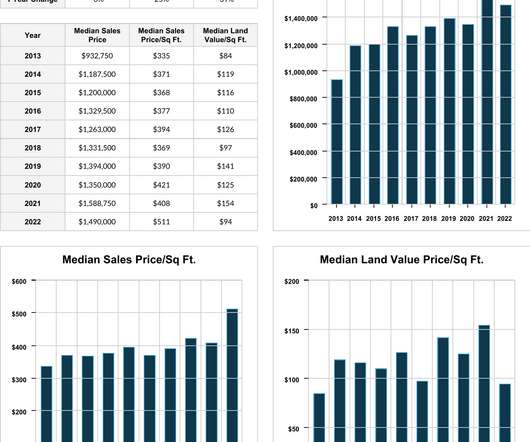

It's been no secret that super luxury Manhattan sales have been the hardest hit segment of the market since 2014. The slowdown is related to the oversupply of new development created from the vast amounts of capital looking for a home since the financial crisis.

Let's personalize your content