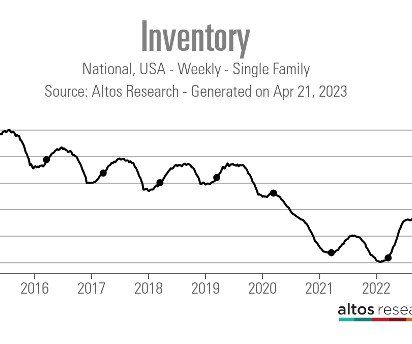

Housing Market Tracker: Inventory finally rises

Housing Wire

APRIL 23, 2023

Can we now say that the housing market ‘s spring selling season is finally underway? We didn’t see too much volatility in mortgage rates last week, but purchase apps declined in reaction to rates rising two weeks ago. Mortgage rates started the week off at 6.61% and ended at 6.66%, so a calm week on the rate front.

Let's personalize your content