Mortgage market affordability and inventory challenges

Housing Wire

JULY 7, 2022

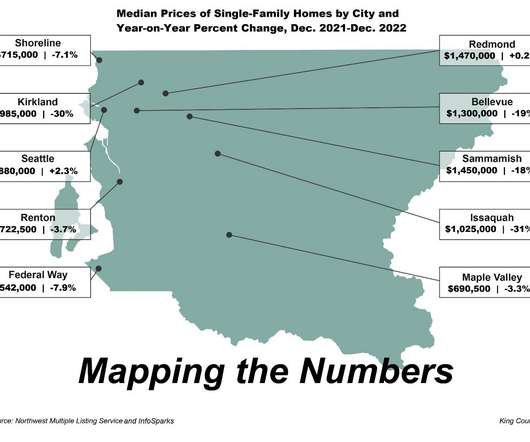

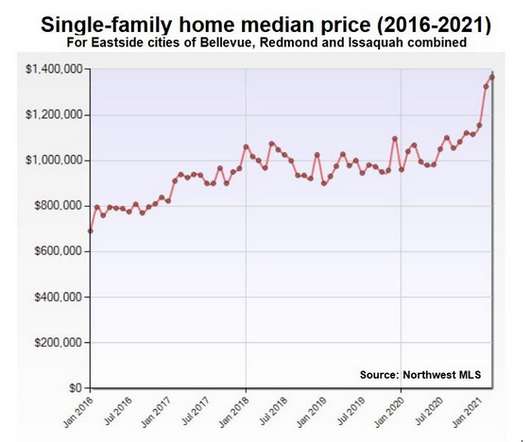

In Portland, Oregon, for example, one loan officer noted that new listings doubled in the second half of May from 800 to 1,900 new listings. In Seattle, Dan Keller reported 47% of all listings had price reductions. Slow construction and restrictive zoning laws.

Let's personalize your content