The risk of zero-down loans while the Fed talks recession

Housing Wire

SEPTEMBER 8, 2022

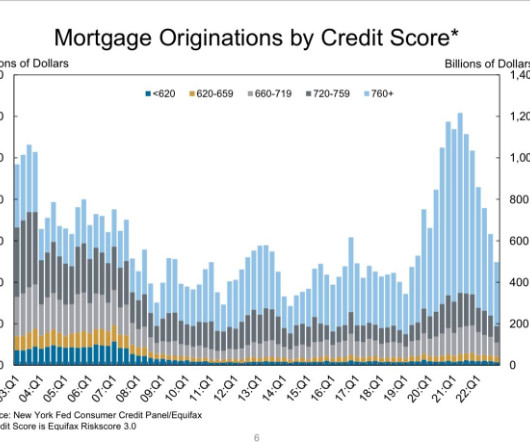

Well, it isn’t 2008, but this type of loan does have risk — and it’s the risk that is traditional among all late economic cycle lending in America when the loan requires low or no downpayment. So when you add move-up buyers, move-down buyers, first-time homebuyers, cash buyers and investors together, this can get out of hand.

Let's personalize your content