Logan Mohtashami unpacks the slow train wreck that’s been happening in housing inventory

Housing Wire

JUNE 2, 2022

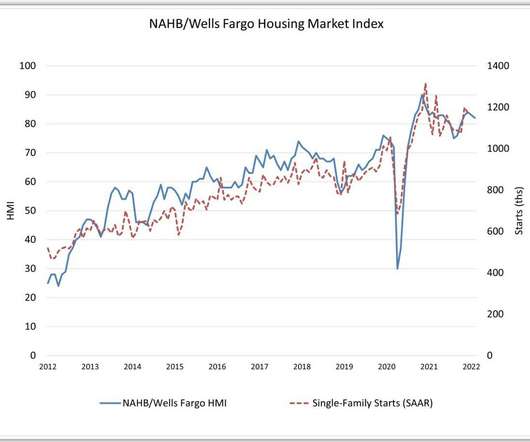

I always try to focus people on the total inventory data until we get inventory back into a range of 1.52-1.93 HousingWire: To add to that, since housing is in an inventory shortage, the market has changed, so the good news is inventory is growing. The big difference now than, let’s say, what we saw from 2002-2008.

Let's personalize your content