Spring housing market gets more inventory

Housing Wire

APRIL 27, 2024

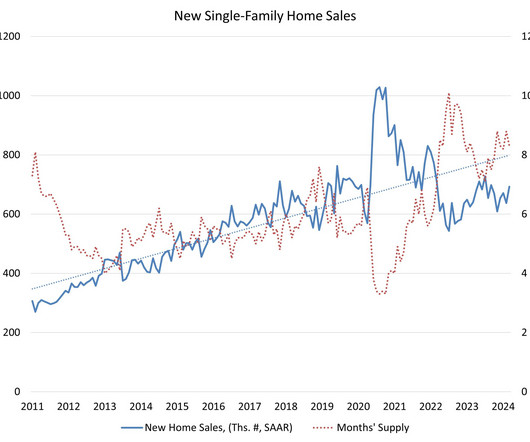

Active weekly housing inventory growth slowed slightly last week, but it’s still running at a healthier clip than in 2023. I have a simple model with mortgage rates being above 7.25%: weekly inventory data should grow between 11,000-17,000 per week. Last year, we never hit that target. We have now seen it for two weeks as inventory grew by 13,247. Weekly housing inventory data We’ve now had back-to-back weeks of healthy housing inventory growth and spring 2024 is much healthier than spring 2023

Let's personalize your content