At Inman Connect Las Vegas, July 30-Aug. 1 2024, the noise and misinformation will be banished, all your big questions will be answered, and new business opportunities will be revealed. Join us.

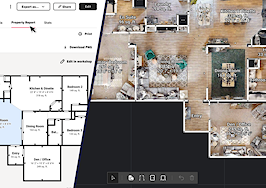

CoStar Group has expanded with the acquisition of Matterport, the dominant 3D scanning company whose products and services create digital replicas of homes, buildings and other spaces, it was announced Monday morning.

CoStar purchased Matterport’s outstanding stock at $5.50 per share, reflecting an equity value of $2.1 billion, according to the company. (The enterprise value is $1.6 billion.) Stockholders will receive $2.75 in cash and $2.75 in shares of CoStar Group stock. Matterport’s board of directors unanimously approved the deal, which is expected to be finalized later this year.

The companies didn’t share details about what it might mean for real estate professionals, but the purchase comes as CoStar continues its expansion path in both the residential and commercial real estate industries.

TAKE THE INMAN INTEL INDEX SURVEY FOR APRIL

“I look forward to welcoming Matterport to the CoStar Group family and believe that we will be stronger together, in pursuit of our common mission,” CoStar CEO Andy Florance said in a statement. “The world has changed and today a Matterport is the new open house or property tour.”

Matterport has been on its own expansion path as it leaned into buyers’ desire to view digital versions of homes while browsing real estate online. It has marketed its services as a way for Realtors to enhance listings and sell properties faster and for more money.

Matterport had not yet become a profitable company, instead focusing on gaining market share during and after the pandemic as homebuyers increasingly shopped for property online.

The company had been growing its revenue from services and products such as its Pro3 camera.

While the company had been largely credited with creating the online home touring experience, Matterport has also been marketing its products and services to the commercial real estate sector and more broadly in business.

Matterport CEO RJ Pittman said in February that the company was adding Fortune 1000 companies as clients, saying they were using the technology to become more efficient in planning, designing and managing buildings.

CoStar has long been a Matterport customer, Pittman said.

“With CoStar Group’s expansive reach and scale in property research and analytics and our joint commitment to innovation, we believe that this powerful combination will transform how properties are marketed, sold, and managed worldwide,” Pittman said in a statement.

CoStar’s purchase comes as the company expands its footprint in both commercial and residential real estate.

It’s not clear what the acquisition of Matterport will mean for agents, who have increasingly added digital twins to online listings. But it comes at a time when CoStar has focused on enticing more residential agents to work with it.

The company launched a $1 billion advertising campaign earlier this year to highlight its residential portal, Homes.com, which it said has grown into the second-largest portal behind Zillow.

Financial analysts with the firm William Blair said they could see CoStar adding Matterport capabilities as a perk of being a member with Homes.com.

“We see potential for CoStar to layer Matterport solutions into Homes.com memberships (e.g. “buy a Homes.com membership, and get access to Matterport capabilities”), which could make Homes.com even more attractive to seller-focused agents with another competitive differentiator,” William Blair proptech analyst Stephen Sheldon wrote in a report released shortly after the news broke.

Sheldon said the merger could lead to efficiencies for both CoStar, which will benefit from owning existing property twins and content from Matterport photographers, and Matterport, which will benefit from CoStar’s reach as it expands globally.

Still, William Blair analysts believe CoStar may have overpaid for the company and could create antitrust concerns from regulators.

“Overall, considering the valuation being paid, we believe CoStar will need to clearly communicate the strategic and financial benefits,” Sheldon wrote.