Image Analytics from CoreLogic helps users analyze property images quickly and accurately

Housing Wire

AUGUST 29, 2023

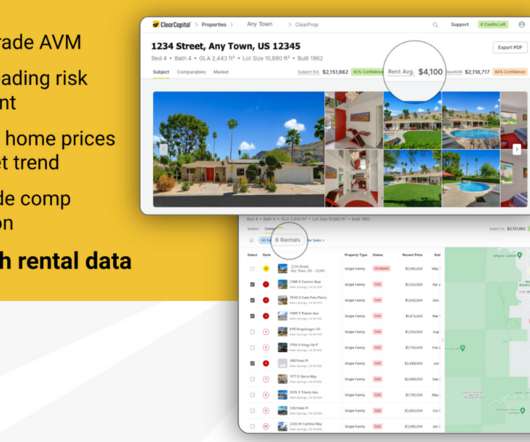

Reviewing appraisal imagery, an essential step in the valuation review process, is time-consuming and laborious. CoreLogic developed Image Analytics to drive innovation in the appraisal review process and help lenders and mortgage industry professionals analyze property images quickly and accurately.

Let's personalize your content