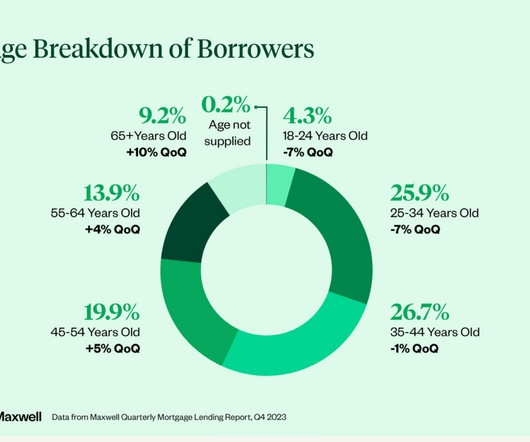

The worst for mortgages may be over, but younger borrowers still face affordability challenges

Housing Wire

FEBRUARY 12, 2024

Loan volume between the third and fourth quarters declined by 21%, but that was far less than the 37% drop from Q3 2022 to Q4 2022, the report showed. Meanwhile, loan volume in the fourth quarter was up by 1% year over year, a significant increase from the annualized decline of 65% in Q4 2022.

Let's personalize your content